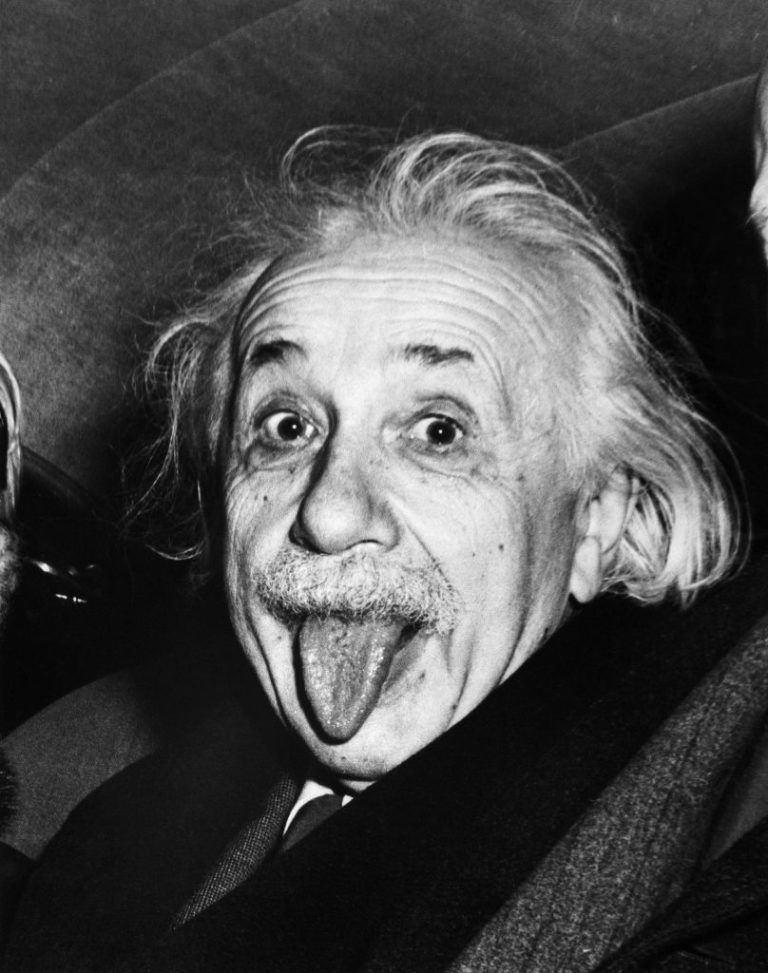

Test your knowledge with this 10 Questions R&D Quiz

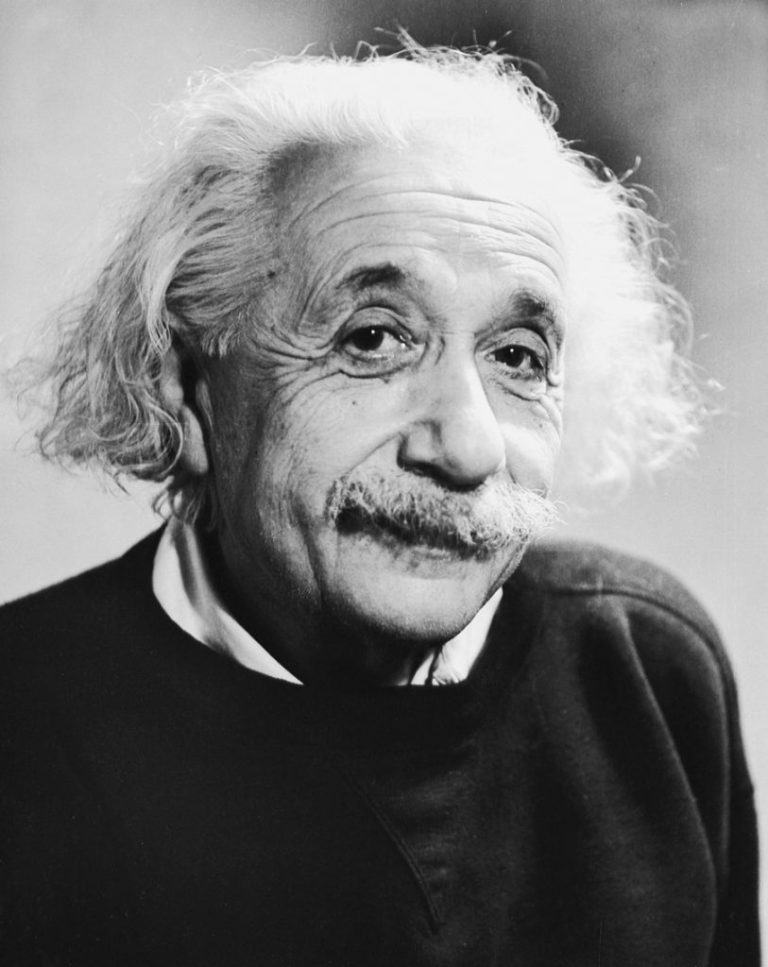

The R&D Tax credit is one of the most complex areas of the Income Tax Act. In fact, over recent years, the CRA has frequently evolved it into an “uncertain tax position”. Because of these many claimants (including some R&D experts and CPAs) are now uncertain about what qualifies or not for claiming the R&D credit.

You think you’re an R&D tax credit expert? You don’t need help from anybody? Let’s see how much this is true.

- New knowledge is always an advancement, so even learning what will not work is an advancement.

- Improvements to existing products can qualify for the research credit.

- Qualified research expenditures for prototype development include material cost, consultants cost and labor cost.

- SR&ED begins when you have exhausted all known standard practices.

- A custom product developed to meet customer specifications is usually claimable.

- Expenditures of a capital nature for capital property acquired for use in R&D qualify for SR&ED tax incentives.

- All technological innovation development activities automatically qualifies to SR&ED

- User acceptance testing is a claimable SR&ED activity.

- Market Research activities are claimable as SR&ED when they are part of a SR&ED project.

- What distinguishes an R & D approach from a SR & ED approach is the achievement or not in the development process of the limits of the underlying technology.

Results

Réponses 1 :T 2 :T 3 :T 4 :T 5 :F 6 :F 7 :F 8 :F 9 :F 10 :T

6/10 is a strict minimum, you are excellent if you have 9 or 10 /10

Thank you for taking the time to read our page. The index of our blog (to the right of this page) contains several other answers and solutions that are also intended for you. Did you like your reading? Tell us so. What should be added? What topics are you interested in? You did not like this reading? Tell us so. What is it that you disliked?