Audit

The 10 Commandments of a Successful SR&ED Audit explains what NOT to do at the very important SR&ED audit meeting

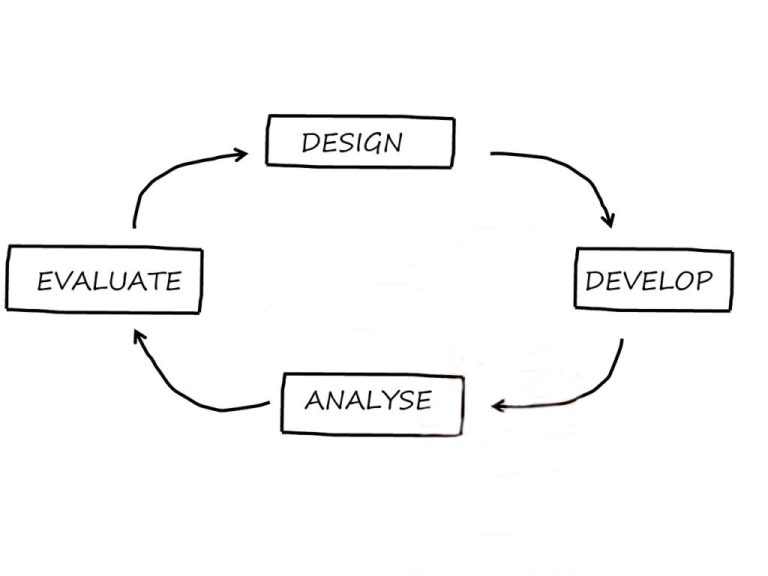

The SR&ED Audit meeting is critically important. It's going like a chess game: you must plan many shots in advance and aim to answer all the CRT's issues.

At the audit meeting, you explain the systematic experimental process and you justify the reasonability of the costs claimed.

An audit can not be avoided, but the negative impacts can certainly be minimized. How do you prepare a SR&ED audit meeting?

Do your employees know what to say and how to say it at the SR&ED Audit meeting ? EVERYBODY must prepare and practice it's presentation

The audit by the CRA is certainly THE crucial moment in the claiming process for SR & ED tax credits. Who do you prepare for the SR&ED Audit ?

That's it ! You received the fateful call (or letter)! Your SR & ED claim is selected for an audit! Here are the questions to ask immediately to the CRA

How safe are you with your next tax credit claim for R&D ? Here are 10 questions to evaluate your risk of SR & ED audit.