Identification

How to benefit SR&ED as a foreign company? There are two answers : through a canadian subsidiary or a CCPC. It is one of the most generous R&D support program in the world

Develop your business with a SR&ED partnership. If you plan it well, you can use the SR&ED tax credit to accelerate your growth.

Share the SR&ED benefit to reach new clients while developping your technologies. The key is to plan the development and the credit.

Finding SR & ED in IT means : forget the features and focus on the technology and on ways to go beyond its limits.

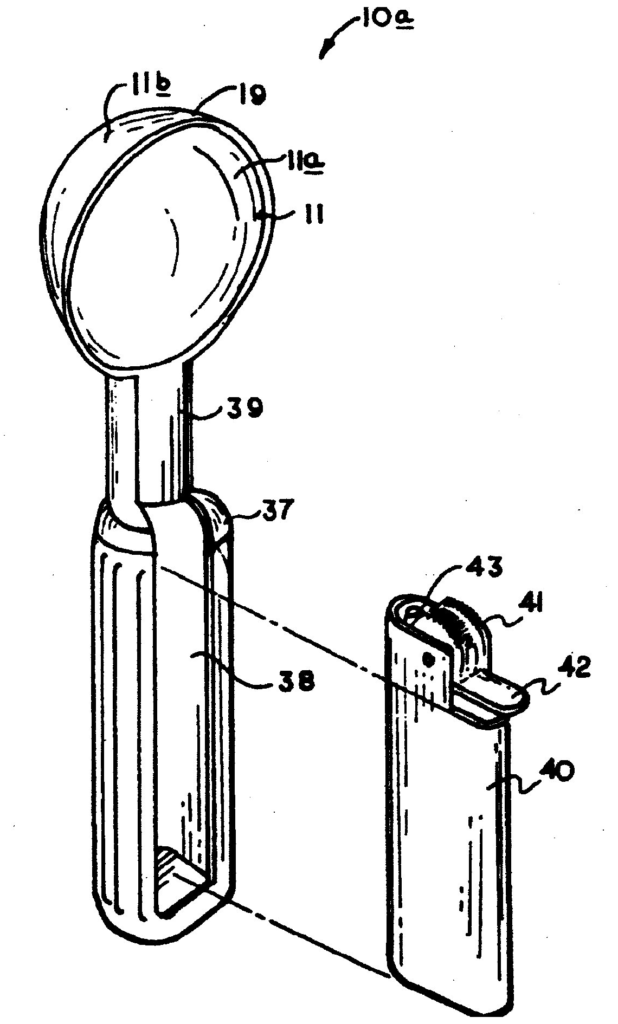

You believe that your project may qualify? Start now to document your processes, your goals, your hypothesis, your results, your timesheets and conclusions.

Finance the development of your technology in Canada regardless of the area in which you operate : IT, Manufacturing, Chemistry, Gaming, Environment, etc.