Interpretation

Test your knowledge of the R&D tax credit and update it to identify the eligible activities to the SR&ED program.

Identifying routine work and standard practice is important because if the RTA finds it first, well... you are in for a tough ride to change his mind

Test your knowledge of the SR&ED tax credit and see if you need help in your actual or future claims

The Canada Revenue Agency (CRA) uses the following 5 questions for SR&ED to determine whether your work meets the definition of SR & ED.

10 Questions R&D Quiz. Many are unsure about SR&ED : what is eligible and what is not - Test your knowledge with this quiz.

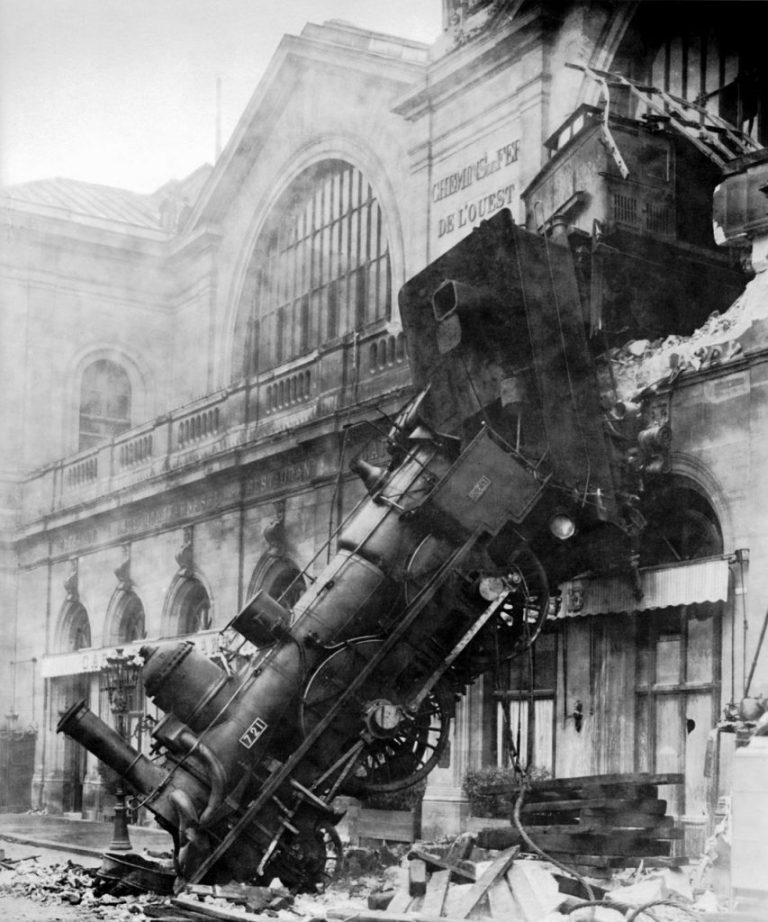

Murphy said « If anything can go wrong, it will ". Here are a few variations on that theme

The CRA has adopted a more rigorous approach to defining what can be claimed as SR & ED. As a result, there are more audits, disputes and objections.