Let’s move to the third step: How to prepare your team for the audit meeting.

Prepare why?

Do your people know what to say? How to tell it? Let us be clear. We don’t talk about hiding information or defraud the tax. However, it is essential to use the time we have available to convince the CRA without wasting time on irrelevant subjects. We must therefore organize our meeting efficiently.

- This is not a meeting like any other. No one is accustomed to this kind of meeting. This is not about selling a product, or understanding the needs. This is about convincing a listener of the merits of our claim, that we satisfied the eligibility criteria project. The what?This is precisely why we must prepare everyone attending the meeting.

- This is about “meeting the tax guys”. For many employees, this prospect is horrifying. They never had to meet an auditor before. It’s already tough for many employees to meet with clients. But this is even worse. It’s official. Why are they there? Will I be sued or go to jail if things go wrong? They do not know what’s coming. The unknown is scary. That is why we must demystify it. We must show them what will happen, what is the agenda, who are the CRA auditors and reduce their anxiety about this unknown situation.

- We do not know how they will react in real time. We must guide them, make them practice to deliver the relevant content. This is the best way to make sure that the staff provides the important arguments quickly and directly during this meeting. Under pressure, some people shut off, or become very anxious and lose the thread of their argument. Others, however, will unpack tons of useless information and give the impression of an attempt to “drown the fish”. Guiding all those who will attend limits these kind of risks.

- Everybody at the meeting must to know what it is going on, what his/her role is, what he has to say or not and how to say it. Otherwise, he represents a free electron, a potential source of problem or wrong quote that may affect the decision of the auditor.

How to prepare?

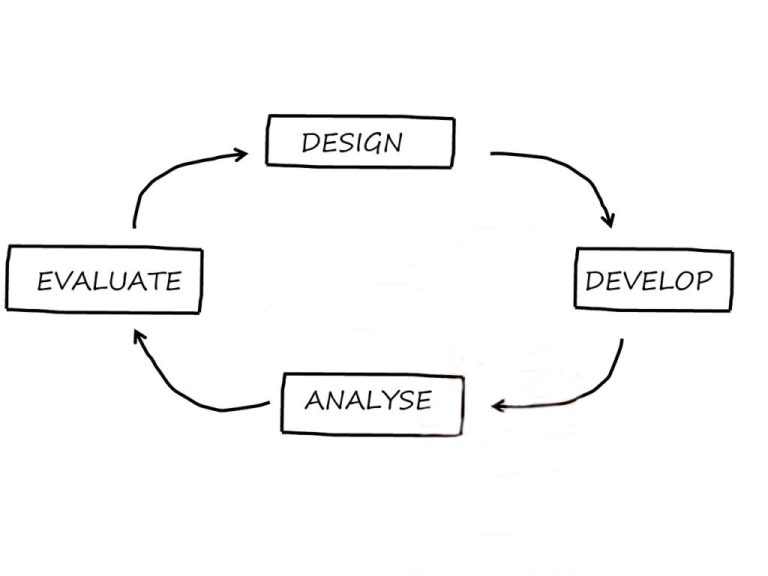

Good staff preparation extends over at least two meetings so that everybody becomes familiar with the progression of the meeting. ALL presenters must prepare and practice their part at least twice.

- In the first preparation meeting, everyone is informed of what is coming, of their role and duties they have to deliver before the second practice meeting. We introduce them to the CRA visitors, their vision and agenda. We also ask them for a very preliminary presentation of their projects. We offer a presentation template (eg. a PowerPoint presentation containing extracts from the T661 descriptions, etc.) and a summary of the costs claimed for their project. We discuss the strengths and weaknesses of their projects in order to obtain their views. A well exposed weakness can often be resolved by discussing with the senior technical resource involved in the project.

- Between the first and the second meeting, presenters must re-read the descriptions submitted in the T661 form,they must find all relevant documentation to illustrate their point. They should also reorganize the presentation in “their own words.”

- Finally, the second meeting is more efficient. The presenters are ready. We must now listen and criticize the content and the format. We guide them to prevent from putting themselves into trouble. We help them deliver their best arguments, their best reasoning, their best examples.

This preparation is done in a logical role play game. Presenters must express themselves in their own words, as if they were in the meeting. Someone (eg. your consultant) plays the role of the CRA advisor. This is necessary to give presenters the feeling of the meeting, the right frame of mind and to avoid the pitfalls.

Demonstration or prototype: Will this demo add to the argument? Does it bring important clues? Is it visual enough to keep the auditor’s interest? The additional preparation and presentation time of a demo is rarely justified by real benefits. If there is no gain, just drop it.

Conclusion

YOU MUST PROPERLY PREPARE for the audit meeting with the CRA. The claimed money is then on the table and if the CRA is there, it is likely they are here to challenge one or many activities you claimed.

In the next article we discuss what to prepare with your team for the audit meeting.

What do you think ? Have you lived through audits where you had no idea what was coming until the “train was on you”? How have you prepared (or not)? What were the results? What lessons have you learned? Why ?

Did you like reading this ? Tell us so. What should be added ? What are you interested into ? You did not like reading this ? Tell us so. What is it that you disliked ?